Mortgage interest tax deduction 2020 calculator

The new rates are 10 12 22 24 32 35 and 37They will phase out in eight years. About one third of all taxpayers claim an itemized deduction with the most common deductions including mortgage interest and state local taxes.

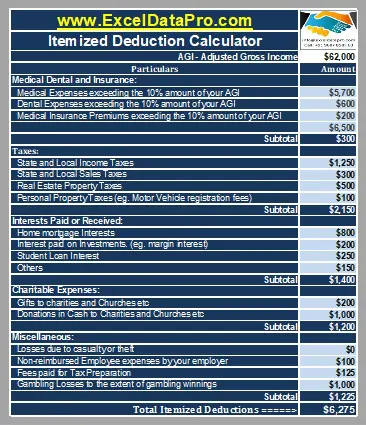

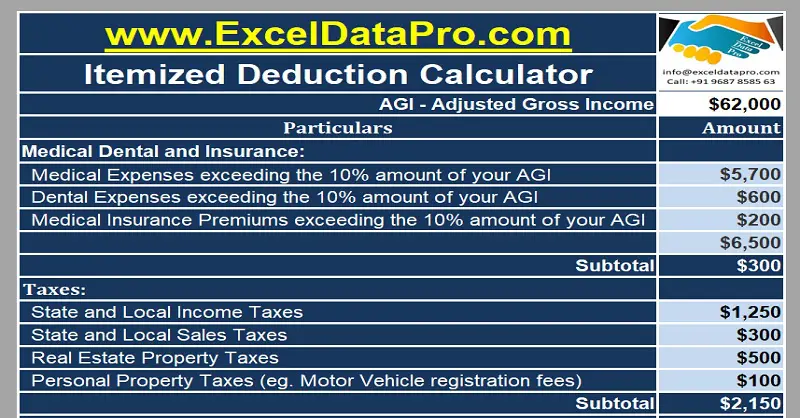

Download Itemized Deductions Calculator Excel Template Exceldatapro

Which had them paying both halves of the tax.

. Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Mortgage Tax Benefits Calculator.

But the 2018 tax law no longer allows the deduction of interest paid. The Missouri standard deduction is tied to the federal deduction. Mortgage interest is reported on Form 1098.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. Changes the Seven Tax Rates. This means that for the 2020 tax year its 12550 for individual filers 25100 for joint filers and 18800 for heads of household.

Add your total state and local taxes capped at 10000 to the mortgage interest number you calculated above. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage. Even the section 80CCC on pension scheme contributions was merged with the above 80C.

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Tax Reform Changes for Tax Years 2018. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Free estate tax calculator to estimate federal estate tax in the US. This law greatly affected the tax deduction for interest on a mortgage refinance loan. On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000.

Section 80C replaced the existing Section 88 with more or less the same investment mix available in Section 88. American opportunity credit Form 8863. CTEC 1040-QE-2355 2020 HRB Tax Group Inc.

See Form 5695 for more information. 2 The limit on home equity interest deduction is not 100000 of interest but rather the interest on 100000 of home equity debt. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

The final step is to claim deductions. Allows you to take a tax deduction even if you have no expenses that qualify for claiming itemized deductions. Changes in tax law went into effect on January 1 2018 with the Tax Cuts and Jobs Act TCJA.

The changed rules are tighter than they were in 2017. If you itemize your deductions on Schedule A Form 1040 you must reduce your home mortgage interest deduction by the amount of the mortgage interest credit shown on Form 8396 line 3. Married couples have the option to file jointly or separately on their federal income tax returns.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. How Income Taxes Are.

Mortgage loan basics Basic concepts and legal regulation. Compare the mortgage interest rate deduction with the standard deduction. If the total is larger than your standard deduction youll likely benefit from itemizing.

Earned Income Tax Credit The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in. Self-Employed defined as a return with a Schedule CC-EZ tax form. Mortgage interest deductions are considered itemized.

Try the H. This calculator is for the 2022 tax year due April 17 2023. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

For 2020 the FICA limit is on the first 137700 of income. In the vast majority of cases its best for married couples to file jointly but there may be a few instances when its better to submit separate. To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements.

Then add in any deductions for state income taxes sales taxes and property taxes and see what number you get. Form 1098-C Contributions of Motor Vehicles Boats and Airplanes. Doubles the Standard Deduction.

The limits on deductions for acquisition debt are far higher than for home equity debt. The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together. Std Deduction 2020.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Also gain in-depth knowledge on estate tax and check the latest estate tax rate. Reducing your home mortgage interest deduction.

The deduction is larger if either you or your spouse is older than 65 or blind. This credit was renewed in 2020 through 2021. However this new section has allowed a major change in the method of providing the tax.

Therefore make sure you know how it will affect you before you think about refinancing your mortgage. Paid mortgage interest and real estate taxes on your home. Add up all of these taxes but remember the IRS limits your state and local tax deduction to 10000.

For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for. For 2020 the additional standard deduction amount for the aged or the blind is 1300The additional standard deduction amount increases to 1650 for unmarried taxpayers. The new section 80C has become effective wef.

Form 1098 Mortgage Interest Statement. Your household income location filing status and number of personal exemptions. The mortgage is a secured debt on a.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The standard deduction amount is increased from 6350 to 12000 for Single and Married Filing Separately filers 12700 to 24000 for Married Filing Jointly and Widow filers. Since 2017 if you take the standard deduction you cannot deduct mortgage interest.

HR Block has been approved by the California Tax. Tax Refund Schedule Dates 2021 2022. The FICA portion funds Social Security which provides benefits for retirees the disabled and children of deceased workers.

Had large uninsured casualty fire flood wind or theft losses. You filed an IRS form 1040 and itemized your deductions. Student loan interest deduction More Important Details and Disclosures.

2020 2021 2022 deduction standard. Is there a limit to the amount I can deduct. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from in-debtedness incurred before December 16 2017.

You cant deduct any of the taxes paid in 2021 because they relate to the 2020 property tax year and you. Acquisition debt comes from using a reverse mortgage to buy a house or refinancing debt that was acquisition debt. All other home equity loans do not have an interest deduction.

IRS Publication 936. Use this 1040 tax calculator to help estimate your tax bill for the current tax years rates and rules.

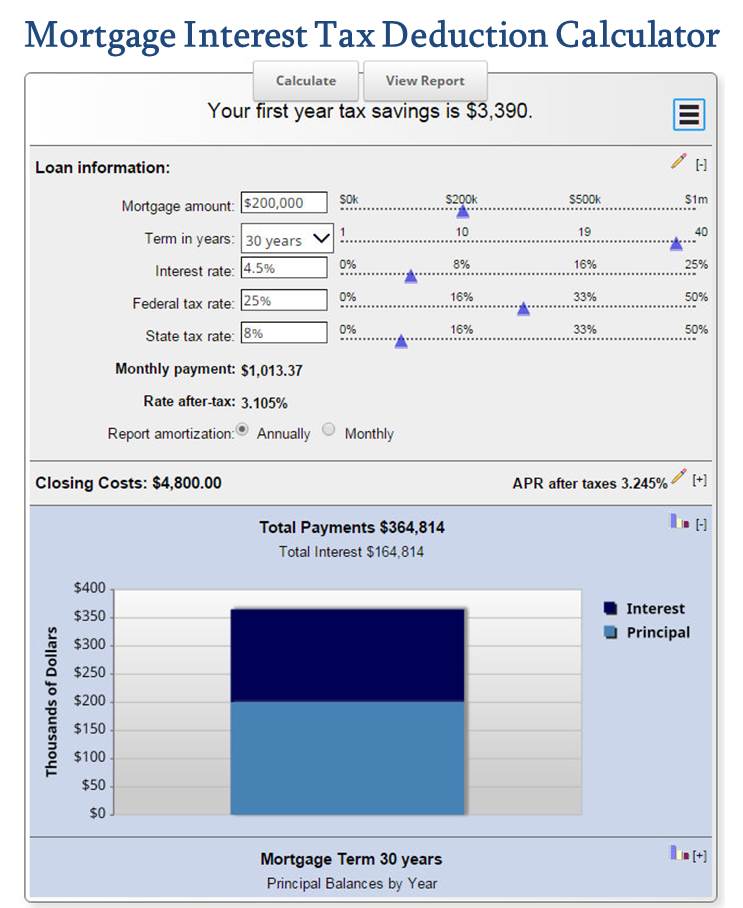

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Tax Deduction Hi Res Stock Photography And Images Alamy

Download Itemized Deductions Calculator Excel Template Exceldatapro

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

10 Creative But Legal Tax Deductions Howstuffworks

Tax Deductions For Home Mortgage Interest Under Tcja

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Tax Deduction Calculator Homesite Mortgage

Mortgage Tax Deduction Calculator Freeandclear

Your 2020 Guide To Tax Deductions The Motley Fool

Mortgage Interest Tax Deduction What Is It How Is It Used

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Best Home Office Deduction Worksheet For Excel Free Template

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Interest Tax Shield Formula And Calculator Excel Template